New Jersey Property Tax Rate 2021 . The general tax rate is a multiplier for use in determining the. general tax rates by county and municipality. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. That was largely in line with a trend. county, municipal and school budget costs determine the amount of property tax to be paid. The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax calculator 2021. property tax rates in new jersey will vary depending on the county and municipality. When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,700. Below you will find a complete list of town. *hqhudo 7d[ 5dwhv ',675,&7 *hqhudo 7d[ 5dwh (iihfwlyh 7d[ 5dwh $8'8%21 %252 $8'8%21 3$5.

from www.njpp.org

general tax rates by county and municipality. *hqhudo 7d[ 5dwhv ',675,&7 *hqhudo 7d[ 5dwh (iihfwlyh 7d[ 5dwh $8'8%21 %252 $8'8%21 3$5. When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,700. The general tax rate is a multiplier for use in determining the. county, municipal and school budget costs determine the amount of property tax to be paid. property tax rates in new jersey will vary depending on the county and municipality. Below you will find a complete list of town. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax calculator 2021. That was largely in line with a trend.

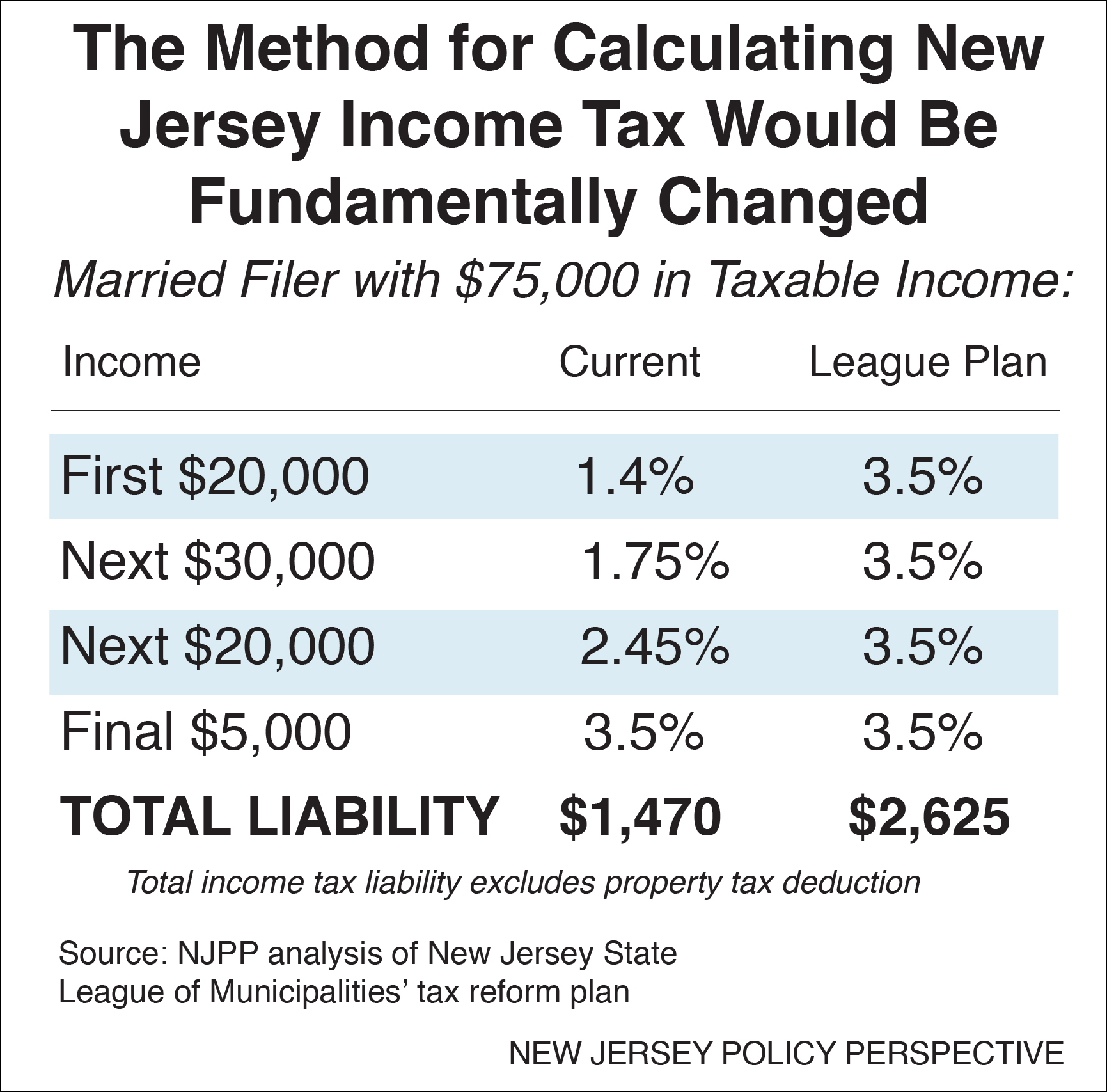

Why Significant, Lasting Property Tax Reform is So Difficult New

New Jersey Property Tax Rate 2021 the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax calculator 2021. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,700. county, municipal and school budget costs determine the amount of property tax to be paid. *hqhudo 7d[ 5dwhv ',675,&7 *hqhudo 7d[ 5dwh (iihfwlyh 7d[ 5dwh $8'8%21 %252 $8'8%21 3$5. The general tax rate is a multiplier for use in determining the. That was largely in line with a trend. Below you will find a complete list of town. property tax rates in new jersey will vary depending on the county and municipality. general tax rates by county and municipality.

From cechzuey.blob.core.windows.net

Most Expensive Property Taxes In Nj at Lillian Leon blog New Jersey Property Tax Rate 2021 *hqhudo 7d[ 5dwhv ',675,&7 *hqhudo 7d[ 5dwh (iihfwlyh 7d[ 5dwh $8'8%21 %252 $8'8%21 3$5. When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,700. property tax rates in new jersey will vary depending on the county and municipality. The tax tables below include the tax rates, thresholds and allowances. New Jersey Property Tax Rate 2021.

From taxfoundation.org

Will New Jersey be Tied for Highest Corporate Tax Rate? Tax Foundation New Jersey Property Tax Rate 2021 *hqhudo 7d[ 5dwhv ',675,&7 *hqhudo 7d[ 5dwh (iihfwlyh 7d[ 5dwh $8'8%21 %252 $8'8%21 3$5. county, municipal and school budget costs determine the amount of property tax to be paid. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. property tax rates in new jersey will vary depending. New Jersey Property Tax Rate 2021.

From desotocountytax.blogspot.com

Nj Property Tax Relief Check 2021 Desoto Tax New Jersey Property Tax Rate 2021 county, municipal and school budget costs determine the amount of property tax to be paid. general tax rates by county and municipality. Below you will find a complete list of town. That was largely in line with a trend. The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax calculator 2021.. New Jersey Property Tax Rate 2021.

From patch.com

Here's The 'Average' Property Tax Bill In Montclair Montclair, NJ Patch New Jersey Property Tax Rate 2021 general tax rates by county and municipality. property tax rates in new jersey will vary depending on the county and municipality. The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax calculator 2021. county, municipal and school budget costs determine the amount of property tax to be paid. The general. New Jersey Property Tax Rate 2021.

From www.pinterest.com

NJ's high property taxes keep rising — average now 8,953 Check out New Jersey Property Tax Rate 2021 That was largely in line with a trend. The general tax rate is a multiplier for use in determining the. property tax rates in new jersey will vary depending on the county and municipality. county, municipal and school budget costs determine the amount of property tax to be paid. general tax rates by county and municipality. The. New Jersey Property Tax Rate 2021.

From exoqweyvc.blob.core.windows.net

Union County Property Tax Rate 2021 at Dexter Nesbitt blog New Jersey Property Tax Rate 2021 Below you will find a complete list of town. When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,700. That was largely in line with a trend. The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax calculator 2021. property tax rates in. New Jersey Property Tax Rate 2021.

From patch.com

Highest NJ Property Tax Rates See How Your Town Compares To Others New Jersey Property Tax Rate 2021 property tax rates in new jersey will vary depending on the county and municipality. Below you will find a complete list of town. When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,700. The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax. New Jersey Property Tax Rate 2021.

From exoqweyvc.blob.core.windows.net

Union County Property Tax Rate 2021 at Dexter Nesbitt blog New Jersey Property Tax Rate 2021 When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,700. general tax rates by county and municipality. property tax rates in new jersey will vary depending on the county and municipality. The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax calculator. New Jersey Property Tax Rate 2021.

From www.skoloffwolfe.com

Jersey City Finalizes a 6 Property Tax Rate Increase for 2023 New Jersey Property Tax Rate 2021 The general tax rate is a multiplier for use in determining the. general tax rates by county and municipality. That was largely in line with a trend. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. *hqhudo 7d[ 5dwhv ',675,&7 *hqhudo 7d[ 5dwh (iihfwlyh 7d[ 5dwh $8'8%21 %252. New Jersey Property Tax Rate 2021.

From www.attomdata.com

Property Taxes on SingleFamily Homes Rise Across U.S. in 2021 ATTOM New Jersey Property Tax Rate 2021 the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. Below you will find a complete list of town. The general tax rate is a multiplier for use in determining the. That was largely in line with a trend. *hqhudo 7d[ 5dwhv ',675,&7 *hqhudo 7d[ 5dwh (iihfwlyh 7d[ 5dwh $8'8%21. New Jersey Property Tax Rate 2021.

From www.njspotlightnews.org

Charting property taxes in New Jersey NJ Spotlight News New Jersey Property Tax Rate 2021 When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,700. general tax rates by county and municipality. property tax rates in new jersey will vary depending on the county and municipality. *hqhudo 7d[ 5dwhv ',675,&7 *hqhudo 7d[ 5dwh (iihfwlyh 7d[ 5dwh $8'8%21 %252 $8'8%21 3$5. The general tax. New Jersey Property Tax Rate 2021.

From dxoqefbag.blob.core.windows.net

Map Of Nj Property Tax at Kenton Pascoe blog New Jersey Property Tax Rate 2021 That was largely in line with a trend. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. *hqhudo 7d[ 5dwhv ',675,&7 *hqhudo 7d[ 5dwh (iihfwlyh 7d[ 5dwh $8'8%21 %252 $8'8%21 3$5. Below you will find a complete list of town. general tax rates by county and municipality. The. New Jersey Property Tax Rate 2021.

From www.strashny.com

State and Local Sales Tax Rates, Midyear 2021 Laura Strashny New Jersey Property Tax Rate 2021 When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,700. That was largely in line with a trend. Below you will find a complete list of town. The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax calculator 2021. The general tax rate is. New Jersey Property Tax Rate 2021.

From exokmymee.blob.core.windows.net

What Is The Property Tax Rate In Nj at Timothy Holyfield blog New Jersey Property Tax Rate 2021 *hqhudo 7d[ 5dwhv ',675,&7 *hqhudo 7d[ 5dwh (iihfwlyh 7d[ 5dwh $8'8%21 %252 $8'8%21 3$5. Below you will find a complete list of town. That was largely in line with a trend. The general tax rate is a multiplier for use in determining the. The tax tables below include the tax rates, thresholds and allowances included in the new jersey. New Jersey Property Tax Rate 2021.

From www.youtube.com

New Jersey Property Taxes NJ Property Tax Assessment 2022 Video Free New Jersey Property Tax Rate 2021 county, municipal and school budget costs determine the amount of property tax to be paid. When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,700. property tax rates in new jersey will vary depending on the county and municipality. *hqhudo 7d[ 5dwhv ',675,&7 *hqhudo 7d[ 5dwh (iihfwlyh 7d[. New Jersey Property Tax Rate 2021.

From staybite11.bitbucket.io

How To Lower Property Taxes In Nj Staybite11 New Jersey Property Tax Rate 2021 property tax rates in new jersey will vary depending on the county and municipality. The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax calculator 2021. county, municipal and school budget costs determine the amount of property tax to be paid. general tax rates by county and municipality. *hqhudo. New Jersey Property Tax Rate 2021.

From www.njpp.org

Why Significant, Lasting Property Tax Reform is So Difficult New New Jersey Property Tax Rate 2021 county, municipal and school budget costs determine the amount of property tax to be paid. Below you will find a complete list of town. When combined with relatively high statewide property values, the average property tax payment in new jersey is over $8,700. general tax rates by county and municipality. the average effective property tax rate in. New Jersey Property Tax Rate 2021.

From exoqweyvc.blob.core.windows.net

Union County Property Tax Rate 2021 at Dexter Nesbitt blog New Jersey Property Tax Rate 2021 Below you will find a complete list of town. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. The general tax rate is a multiplier for use in determining the. The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax calculator 2021. . New Jersey Property Tax Rate 2021.